Main components

- Platform designed to support a credit risk management process

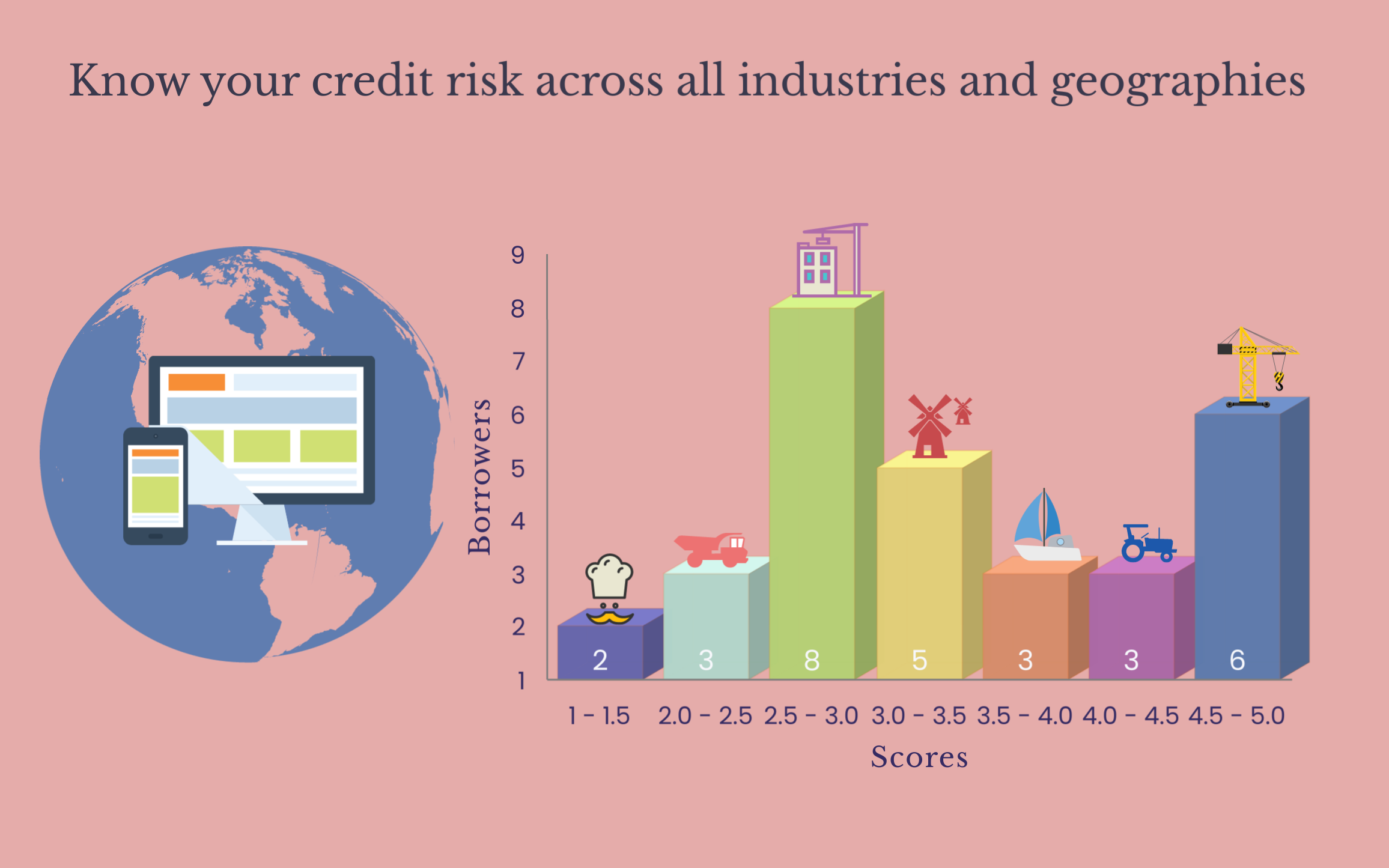

- The platform models assess credit risk for organisations across all corporate industries (PD/LGD/ECL)

- The user can generate quick and easy company score with a complete credit report

- Excellent tool for benchmarking internal assessments or using as an internal rating system

Service Includes

- Fully Transparent Models

- Global coverage

- Workflow with a Smart Reporting Dashboard

- Unlimited Scoring

- Annual Update

- Technical Support

Complete transparency and control

- Glass box, not a black box – you know where the risk is, hence easy to use for stress testing, back testing and validating existing systems and processes

- Single source data - greater accuracy, reduced volatility

- Benchmarked to ratings generated by major rating agencies – gives you confidence, saves you a fortune

- Follow-on support - at no extra charge

Next Steps

- Complete discovery and configuration process

- Try and test

- Subscribe to use immediately

Learn More

A consistent approach is key to comply with regulatory requirements

Copyright 2024, All Rights Reserved, Risk-Enterprise Terms and Conditions | Privacy Policy